There are 2 ways that a business can qualify for ERC: 1) full or partial suspension of business operations as a result of government order or, 2) a significant decline in revenue compared to the same quarter in 2019. Decline in revenue is defined as equal of greater than 50% for 2020 and equal or greater than 20% for 2021.

How much are YOU leaving on the table?

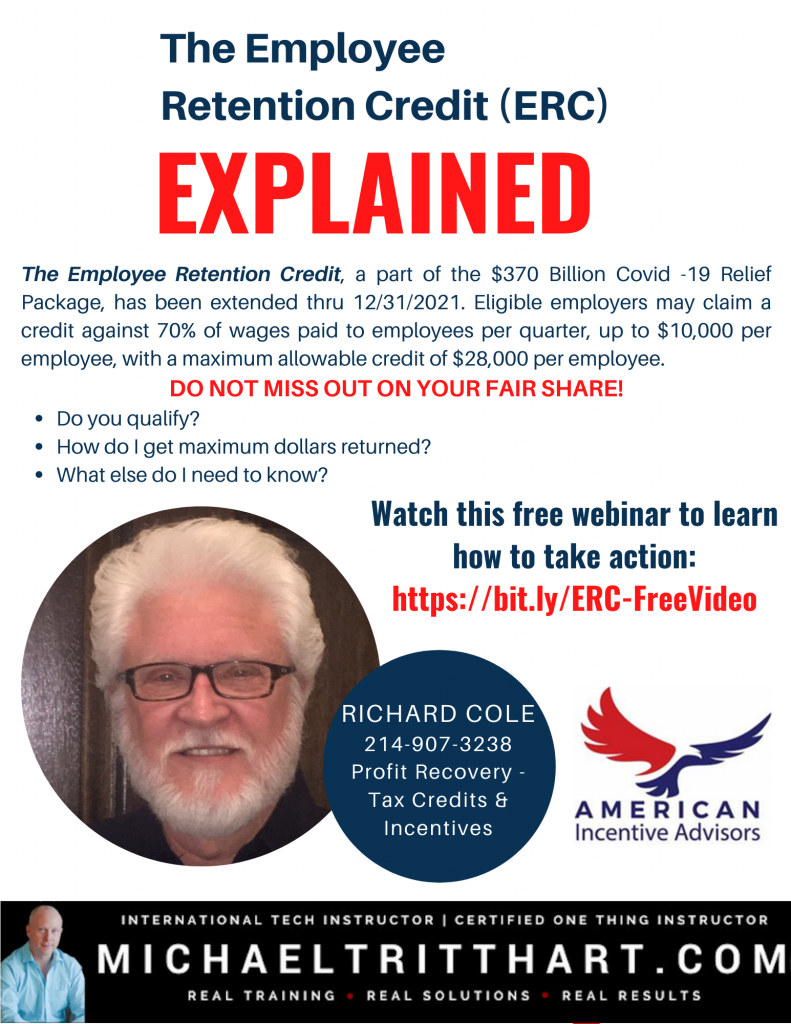

Watch this (FREE) informative video prepared by Richard Cole, a Profit Recovery expert with American Incentive Advisors to learn much more about the ERC and if you qualify!

AIA does not charge an upfront free for this service – financial compensation to AIA only occurs after the eligible employer receives their credit.

Contact: Richard T. Cole | 214.907.3238 | McKinney TX